According to the new market research report "Gas Turbine Market by Technology (Open Cycle and Combined Cycle), Design Type (Heavy Duty and Aeroderivative), End User (Power Generation, Oil & Gas), Rated Capacity (1–40 MW, 40–120 MW, 120–300 MW, Above 300 MW) and Region - Global Forecast to 2026", published by MarketsandMarkets™, The global Gas Turbine Market is projected to reach USD 22.5 billion by 2026. The Gas Turbine Market was valued at USD 18.9 Billion in 2021 and is projected to reach USD 22.5 Billion by 2026, at a CAGR of 3.6% during the forecast period, owing to an increase in demand for gas turbines in power generation.

The power generation segment is expected to lead the gas turbine market

The increase in electricity demand is expected to drive the power generation market for the gas turbines market. In the industrial sector, gas turbines deliver a consistent power supply to the production floor. Gas turbines are preferred in small and medium industries, as their initial installation cost is less than that of steam and diesel power plants.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=94641697

Combined cycle segment is expected to grow at a faster rate during the forecast period

The combined cycle segment is expected to account for the largest share market during 2021 to 2026, driven by more power and low emission. In a combined cycle, the air is compressed in the compressor and heated in a heating chamber. The amount of the gas remains the same as an external source heats the air. In these plants, the waste heat from the gas turbine is used to make steam for producing additional electricity using a steam turbine.

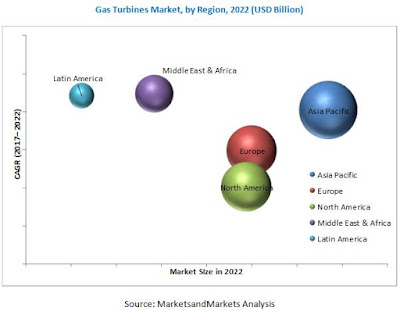

Asia Pacific market accounted for the largest share in 2020 in the gas turbine market

In 2020, the Asia Pacific market accounted for the largest share of the global gas turbines market by region. Rapid economic growth, industrialization, and strict norms for carbon dioxide emission are expected to drive the Asia Pacific gas turbines market. Also, the gas turbines market is expected to grow in countries such as China and India due to infrastructural expansions, ongoing power generation projects, and technological innovations.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=94641697

To enable an in-depth understanding of the competitive landscape, the report includes the profiles of some of the top players in the Gas Turbine Market.

Some of the key players are Kawasaki Heavy Industries, Ltd. (Japan), Siemens Energy (Germany), Capstone Green Energy Corporation (US), General Electric (US), Ansaldo Energia (Italy), Mitsubishi Heavy Industries, Ltd. (Japan), United Engine Corporation (Russia), Rolls-Royce plc (England), Harbin Electric Machinery Company Limited (China), OPRA Turbines (Netherlands), Solar Turbines Incorporated (US), Bharat Heavy Electricals Limited (India), Centrax Gas Turbine (England), MTU Aero Engines AG (Germany), IHI Corporation (Japan), Wartsila (Finland), Doosan Heavy Industries & Construction (South Korea), MAPNA Group (Iran), Vericor Power Systems (US), Zorya Mashproekt (Ukraine), MAN Energy Solutions (Germany). These players have adopted product launches, contracts, partnerships, agreements, collaborations, Memorandum of Understanding (MoU), and joint ventures as their growth strategies.