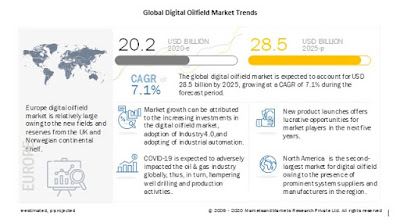

According to the new market research report "Digital Oilfield Market by Solution (Hardware, Software & Service, and Data Storage Solutions), Processes (Reservoir, Production, Drilling Optimizations, Safety Management), Application (Onshore and Offshore), and Region - Global Forecast to 2026", published by MarketsandMarkets™, the global digital oilfield market size is expected to grow from an estimated USD 24.3 billion in 2021 to USD 32.0 billion by 2026, at a CAGR of 5.6%, during the forecast period. The key drivers for the digital oilfield market include new technological advancements in oil & gas industry; increased return on investment in oil & gas industry; and growing need for maximizing production potential from mature wells.

The production optimization held the largest share of the digital oilfield market, by process in 2020. The growth of the production optimization segment is driven by the need to improve production efficiency. The market for the production optimization in Europe is expected to grow at the 5.8% CAGR during the forecast period.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=904

The onshore segment is the largest contributor in the digital oilfield market

The onshore segment is estimated to lead the digital oilfield market. North America was the largest market for onshore application segment in 2020. Increasing number of onshore oil & gas and mature fields is expected to drive the digital oilfield market. Onshore wells are extensively drilled globally, with more oil and gas production potential from regions such as the Middle East, North America, Africa, and Asia Pacific. The demand for digital oilfield services and solutions in the onshore application segment is increasing as the cost incurred in oil & gas activities such as drilling and well completion is less onshore compared to the offshore application. The complexity in deepwater drilling, along with the increasing adoption of digital oilfield techniques in regions such as the Middle East and North America, where the maximum oilfields are located onshore, is expected to drive the market for the onshore segment.

Europe is expected to be the largest market during the forecast period.

Europe accounted for the largest share of the global digital oilfield market in 2020. The scope of the European market includes the UK, Norway, Russia, and the Rest of Europe. The Rest of Europe includes Denmark, Italy, and Germany, among others. According to the International Energy Agency, the total crude oil produced by the region in 2019 was 17.1 million barrels per day, which declined by 0.05% as compared to 2018. Moreover, new explorations and field development activities are increasing, thus increasing the opportunities for developing new fields digitally.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=904

The key players in the Digital Oilfield Market include companies such as Halliburton (US), Schlumberger (US), Baker Hughes (US), Weatherford International (US), and NOV (US).