According to the new market research report "Offshore Decommissioning Market by Service (Well Plugging & Abandonment, Platform Removal, Conductor Removal) Depth (Shallow, Deepwater) Structure (Topsides, Substructure) Removal (Leave in Place, Partial, Complete), and Region - Global Forecast to 2027", published by MarketsandMarkets™, the Offshore Decommissioning Market size is expected to grow from an estimated USD 5.2 billion in 2021 to USD 8.0 billion by 2027, at a CAGR of 7.4%. Aging offshore oil & gas infrastructure and maturing fields are driving the offshore decommissioning industry. Low oil prices of the past couple of years have made it even more difficult to maintain low production mature reserves, driving companies to accelerate decommissioning plans for such oil & gas fields.

The well plugging & abandonment is expected to be the largest contributor to the offshore decommissioning market

The market has been segmented by service type, water depth, structure, removal type, and region. The market has been further segmented, by service type, into project management, engineering and planning, permitting and regulatory compliance, platform preparation, well plugging and abandonment, conductor removal, mobilization and demobilization of derrick barges, platform removal (includes topside, jacket removal, subsea), pipeline and power cable decommissioning, materials disposal, and site clearance.

The well plugging and abandonment service segment accounted for the largest share of the market in 2020 and is also projected to grow at the fastest pace during the forecast period. Well plugging & abandonment involves the safe and permanent closure of production or exploration wells and is one of the biggest and most critical activities in any decommissioning project.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=20319591

The shallow water subsegment is estimated to have the highest growth rate in the offshore decommissioning market

Based on depth, the market has been segmented into shallow water and deepwater segments. The application of offshore decommissioning in shallow water projects is estimated to lead the market, both in terms of market value and growth. The shallow water basins on the UK Continental Shelf and the Norwegian North Sea will play a major role in driving the Offshore Decommissioning Market.

Shallow water operations are typically less expensive compared to deepwater operations, and a majority of the old and aging offshore installations are in shallow waters. Thus, the market for offshore decommissioning will be the largest in shallow water projects.

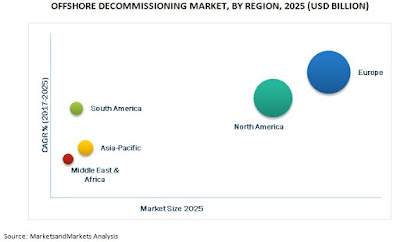

Europe is expected to dominate the global offshore decommissioning market

Europe was the largest market, by value, for offshore decommissioning in 2020, driven mainly by activities in the UK, Norway, and Netherlands. The UK offshore industry leads other regions in terms of well-developed and mandatory decommissioning guidelines. The production of oil, gas liquids, and liquid products in the UK Continental Shelf (UKCS) peaked at around 1,027.5 million barrels in 1999. Ever since the country has struggled to offset the decline in production with both onshore and offshore fields. With a large number of fields in the country near the end of their lifecycles, the market in the UK is projected to be the largest for offshore decommissioning during the forecast period. Authorities in the region are taking active steps to commit operators to decommission old infrastructure by providing expertise, policy support, and financial incentives.

Request Sample Pages:

https://www.marketsandmarkets.com/requestsampleNew.asp?id=20319591

To enable an in-depth understanding of the competitive landscape, the report includes the profiles of some of the top service providers in the Offshore Decommissioning Market. These players include Heerema Marine Contractors (The Netherlands), Royal Boskalis Westminster N.V. (The Netherlands), Petrofac (Jersey), Oceaneering International (US), Baker Hughes Company (US), Halliburton (US), and Schlumberger (US).