The gas

turbines market is estimated to be USD 17.51 billion in 2017 and is projected

to reach USD 20.66 billion by 2022, at a CAGR of 3.36%, from 2017 to 2022. The

increasing demand for natural gas-fired power plants, rising demand for

electricity, reduction in emissions of carbon dioxide, and availability of efficient

power technology are driving the gas turbines market. Natural gas is the cleanliest

source of fossil fuel used to support intermittent generation from renewable

sources. Thus, an increase in the demand for natural gas power plants is

expected as governments implement strict norms for the emission of carbon

dioxide. The shale gas boom in North America and the decommissioning of nuclear

plants in Europe are likely to boost the demand for gas turbines in these

regions. The demand for gas turbines in the Middle East & Africa, Latin

America, and the Asia Pacific is expected to be influenced by the new gas-fired

power plants and the upgrade of old existing thermal power plants in the

regions. Natural gas price volatility and natural gas infrastructure concerns

are the major restraining factors for the gas turbines market.

Scope of the

Report:

Application

·

Power Generation

·

Oil & Gas

·

Other Industrial

Rating Capacity

·

Less than 40 MW

·

40–120 MW

·

120–300 MW

·

Above 300 MW

Region

·

North America

·

Europe

·

Asia Pacific

·

Latin America

·

Middle East & Africa

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=94641697

The power generation application segment is expected to

be the fastest growing segment during the forecast period. The demand for

electricity is growing due urbanization and industrialization. Gas turbines are

used in open cycle and combined cycle plants. Combined cycle power plants are

more efficient than steam turbines as they generate more power. Gas turbines

are used in utilities for base load standby power and peak load applications.

The power generated from combined cycle power plants have lower carbon dioxide

emissions and governments are implementing stricter norms on such emissions.

Thus, an increase in the demand for natural gas power plants will lead to the

growth of the power generation segment. In the oil & gas application, gas

turbines are used to pump natural gas through pipelines where a small part of

the pumped gas serves as the fuel. Industrial gas turbines range from 1,000 to

50,000 HP, with a majority installed in the oil & gas industry.

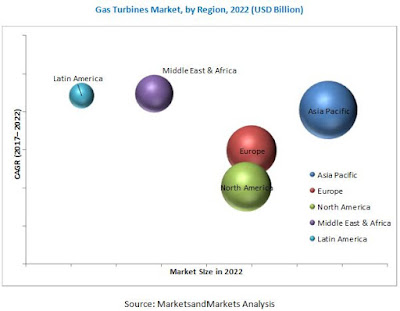

The market in the Asia Pacific is expected to grow

at the highest CAGR from 2017 to 2022.

The market in the Asia Pacific is currently the largest for

gas turbines, followed by the North American and European markets. The Japanese

market accounted for a majority share of the Asia Pacific market in 2016 while

China is projected to grow at the highest CAGR, from 2017 to 2022 The slowdown

in the nuclear power industry due to the Fukushima incident and the continuing

replacement of nuclear and aging coal plants with gas-fired ones would continue

to drive the Japanese gas turbines market. In developing countries such as

China and India, the demand for gas turbines is spurred on by factors such as the

increasing demand for electricity fueled by high levels of urbanization,

industrialization, and infrastructural developments and the subsequent

investments in developing new large gas-fired combined cycle power generation.

The leading players in the gas turbines market include GE (US), Siemens (Germany), MHPS

(Japan), and Ansaldo (Italy).

No comments:

Post a Comment